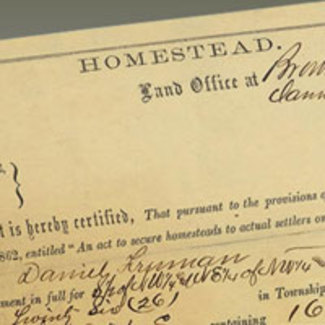

Homesteads

The Massachusetts homestead exemption recently increased from $500,000 to $1,000,0000

In 2024, the Massachusetts Legislature passed Chapter 150 of the Acts of 2024, an Act Relative to the Estate of Homestead, to revise and replace the provisions of the Massachusetts homestead protection law, General Laws Chapter 188.

A few notes about the update:

- The Homestead Act now provides up to $1,000,000 against unsecured creditor claims.

- Homestead protections also are available to properties owned in trust and to life estate interest holders.

- Homeowners who filed a homestead declaration before August 6, 2024 do not need file another homestead.

- If no homestead declaration is filed, the automatic exemption remains at $125,000.

For more information, please see this excellent summary HERE.